VSaaS: Boosting ARPU and Reducing Churn for Telecoms

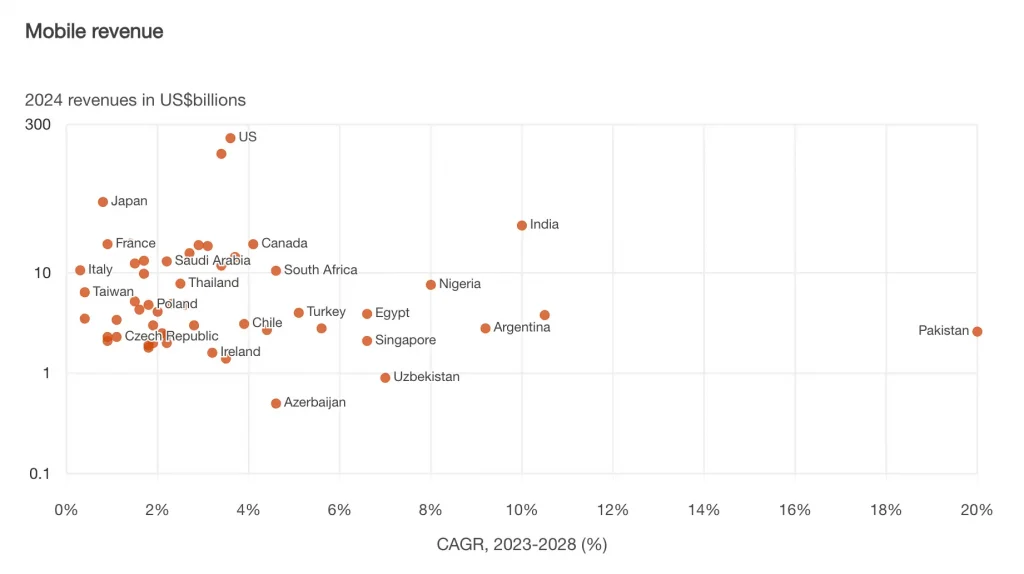

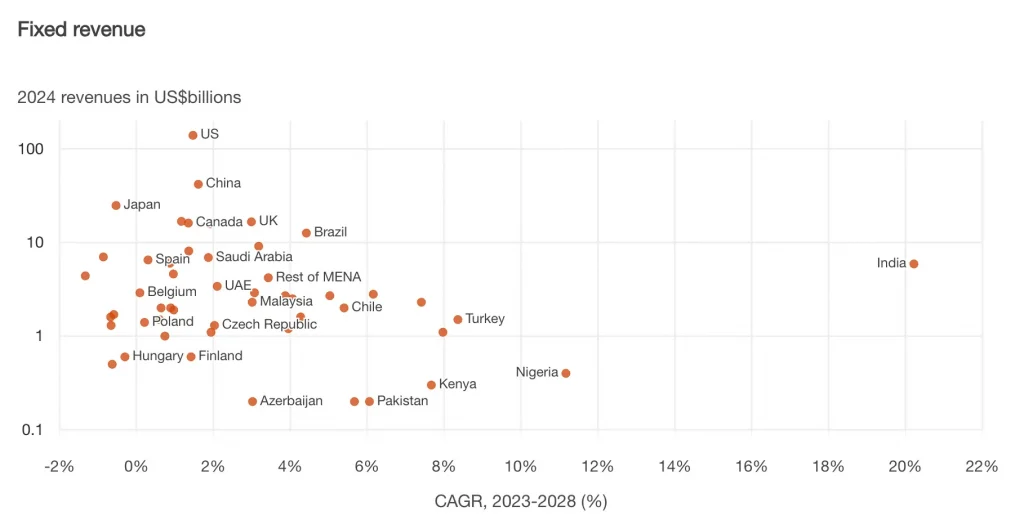

The global telecom industry is mature but still growing: worldwide mobile‐cellular subscriptions total ~9.1 billion (112 per 100 inhabitants). It’s far outnumbering fixed-line subscriptions (roughly 1.5 billion fixed broadband and declining fixed telephone).

However, revenue pressure and market saturation are driving telecom operators toward diversification. It is creating fertile ground for launching Value-Added Services (VAS) like Video Surveillance as a Service (VSaaS). This presents a major opportunity for Telcos and ISPs seeking growth beyond traditional connectivity.

ARPU Trends: Unlocking VSaaS as Telecom Opportunity

ARPU has been under pressure worldwide. GSMA projects only ~1% CAGR in high-income markets (declining in real terms) and slightly higher (~3%) in low-/middle-income countries. PwC also notes declining ARPU in telecoms through 2028.

Some regional insights:

- MENA: ARPU in the Middle East and North Africa is among the lowest globally. Twimbit reports the average ARPU in MENA ~US$13 and essentially flat over the past two years. Competitive markets and macro pressures have kept ARPU stagnant or falling (e.g. a ~2.5% YoY decline in Q2-2024). Within the region, there is wide variation: for example, Telecom Egypt raised ARPU 34.2% (to only ~$3) in Q2 2024 by hiking prices. Overall, limited ARPU expansion is driving MENA operators to target higher-value segments (enterprise, digital services) to boost revenues.

- Central Asia: For 2024–2025, ARPU in Central Asia is estimated to be in the range of $4 to $8 per month. This growth is supported by factors such as continued investment in 4G and 5G rollouts, digital VAS, and strategic tariff adjustments by operators. Countries like Uzbekistan and Tajikistan are also witnessing growth as they modernize networks and expand their service offerings. Although the region still lags behind more developed telecom markets, the direction is clearly upward. ARPU is expected to rise gradually as telecoms improve their monetization models and digital ecosystems mature.

- Latin America: Latin American mobile ARPU tends to range between USD 5 and USD 8 per month. Though this varies by operator and country. Fixed broadband ARPU is often higher but less frequently reported – market reports focus primarily on mobile ARPU. Millicom (serving major LatAm markets) reported a mobile ARPU of USD 6.4 in Q2 2024, a 6.7 % increase year-over-year. Typical ARPU in 2024: approximately USD 6–7/month for mobile services in LatAm.

How VSaaS as Telecom Opportunity can Shift Some Negative ARPU Trends?

Given the current trends in ARPU, it’s clear that telecom operators can no longer depend solely on basic connectivity to sustain or grow their revenues. As previously noted, value-added services (VAS) present a significant opportunity to shift this dynamic. One particularly promising area is Video Surveillance as a Service (VSaaS).

VSaaS holds strong potential across a wide range of customer segments. It includes small and medium-sized businesses (SMBs), public sector entities, and residential users. Its appeal lies in the ability to scale easily and support service bundling with high-value features such as cloud-based video storage, AI-powered analytics, and real-time monitoring. These capabilities enable telcos to introduce premium service tiers. As well as generating incremental revenue per user with minimal additional investment in physical infrastructure.

Churn and Retention: VSaaS as a Telecom Opportunity

Reliable published churn data for these regions is limited. In mature markets, typical annual churn (subscriber turnover) can be on the order of 20–30%. Intense competition in MENA (many countries have 4–5 operators) suggests relatively high churn. One reason ARPU has struggled. Many operators worldwide now focus on loyalty programs and bundled services to improve retention.

How can VSaaS Decrease Churn Rates?

Telecom operators can integrate VSaaS into customer loyalty programs – for example, by bundling basic home security cameras with internet subscriptions. This not only enhances the value of their offerings but also supports customer retention and helps reduce churn. For business clients, VSaaS can be marketed as an advanced surveillance upgrade, complementing existing connectivity services and providing a seamless, all-in-one solution for their operational needs.

On the residential side, operators can offer access to shared-area surveillance (e.g., lobbies, garages, community spaces). Also even facilitate full in-home camera installation for security-conscious users. Additional offerings like smart home integrations, real-time mobile alerts, and remote monitoring further enhance the value proposition.

These kinds of targeted VSaaS solutions open up new revenue streams. Also strengthen the telco’s role as a trusted, full-service provider. By addressing a broader range of customer needs through integrated digital services, telecom operators can build deeper loyalty and solidify their reputation for reliability and innovation in a competitive market.

Final thoughts

With flat ARPU, heavy competition, and saturation in connectivity, VSaaS offers Telcos and ISPs a scalable, high-margin path to growth. The existing broadband base, mobile-first user habits, and 5G rollout make 2024–25 the ideal window to launch regionally adapted VSaaS offerings. Whether through bundling, SME-targeted plans, or smart city integration, VSaaS can become a cornerstone VAS in the next stage of telecom innovation.

Move beyond flat ARPU and saturated connectivity markets by launching VSaaS solutions that deliver scalable growth and strong margins. Take action now to build, launch, and monetize a VSaaS ecosystem that strengthens your competitiveness and accelerates long-term revenue diversification.

Shape the future of telecom—make VSaaS your next growth engine together with Aipix.

Or leave request for free consultation: